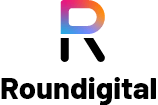

When a business makes a sale, it debits either cash or accounts receivable on the balance sheet and credits sales revenue on the income statement. The primary objective of reconciliation is to identify and resolve any discrepancies between the two sets of records. This helps preserve the integrity of financial statements and identifies errors or fraudulent activities. First, we need to know our total costs for the period (or total costs to account for) by adding beginning work in process costs to the costs incurred or added this period. Then, we compare the total to the cost assignment in step 4 for units completed and transferred and ending work in process to get total units accounted for. In the realm of financial management, ensuring that reported costs align with actual expenditures is a critical yet complex task.

Berry Corporation Reports Third Quarter 2024 Results

Let’s first look at the equivalent units of production using the weighted average method. It keeps businesses on track of their financials and optimizes operations by checking if all financial activities are safe. Having timely access to such suitable adjusted data sources can also provide other benefits. Like better decision-making, financial compliance, and developing products and services that comply with customer expectations. Communication is key when it comes to reconciling the financial accounts of any business. It’s essential for suitable adjustments and the objective of maintaining internal control over financial departments.

Poor information quality/formatting

My first job after college was at Magic Quest, an educational software startup company where I was responsible for writing the content. I found that job somewhat accidentally but after working there a few weeks and loving my job, I decided to pursue a career in technology. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

Why accounting reconciliation matters for businesses

- Elemental cost analysis (ECA) is a valuable practice that breaks construction costs into fundamental elements such as materials, labor, equipment, and overhead.

- The results should also be used to evaluate the business performance, and to plan and implement the necessary actions to improve the cost management and profitability.

- In addition, we believe that Free Cash Flow helps improve investors’ ability to compare our liquidity with that of other companies.

- First, we need to know our total costs for the period (or total costs to account for) by adding beginning work in process costs to the costs incurred or added this period.

- If the results are unsatisfactory, the corrective actions are unsuccessful and the inconsistencies persist.

The insights provided by CVR improve project performance and financial decision-making while controlling risks, bringing more stability to the project. Cost value reconciliation can also become a platform for continuous improvement as project teams learn from mistakes to improve construction cost estimation practices and eliminate variances in the future. CVR also brings additional benefits that contribute to a positive cash flow. Cash flow issues in the construction industry are much too important to ignore. This well-defined process provides deeper insight into project performance while preventing cost overruns, improving transparency, and supporting informed decision-making. CVR is one of many established practices that leverages intelligent construction management software to improve accuracy, efficiency, and collaboration in construction projects.

Revenue Recognition

On a different note, if you’re looking for tools that simplify complex tasks like reconciliation, Bricks might be worth exploring. Bricks seamlessly integrates spreadsheets, documents, and presentations, with AI at its core. It can write formulas, clean data, and even create charts and graphs for you.

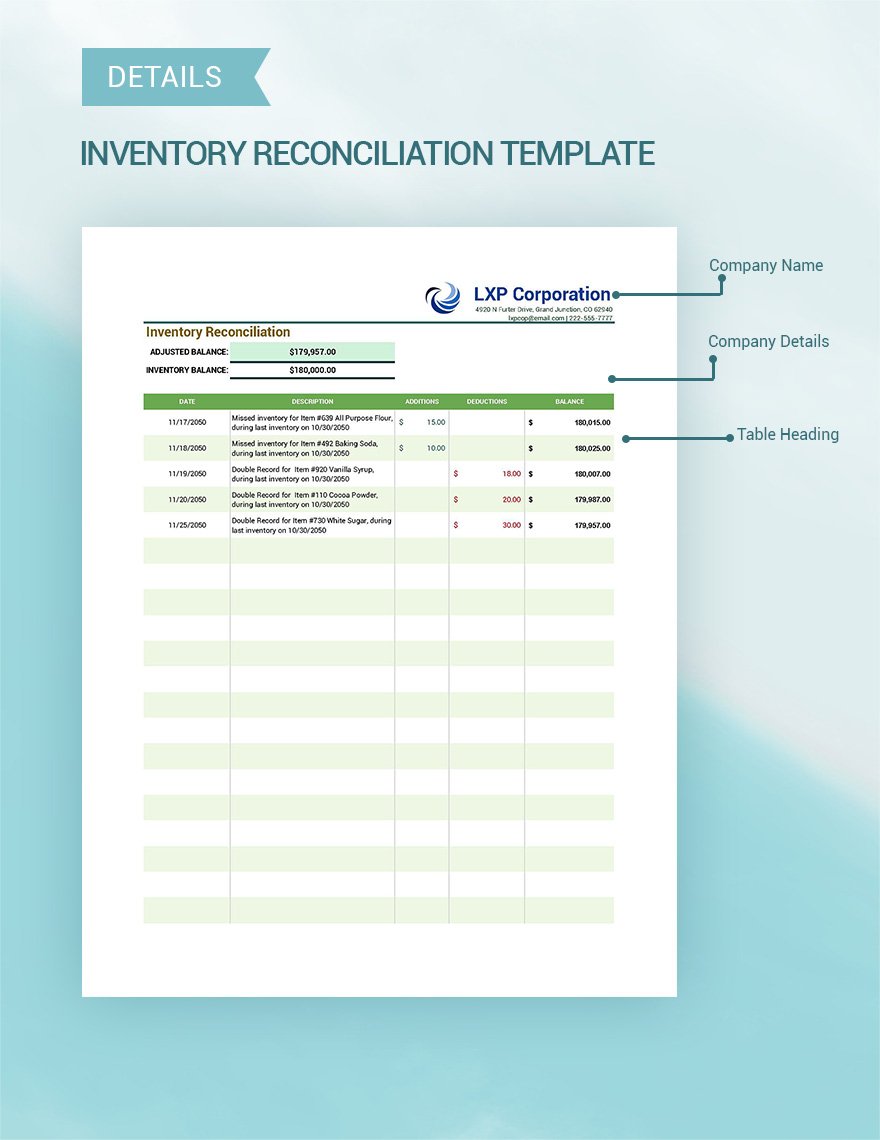

Cost reconciliation is the process of comparing and aligning the reported costs with the actual records to identify discrepancies and ensure financial accuracy. This crucial accounting function involves analyzing cost variances between standard and actual costs, enabling businesses to improve budgeting and cost-control measures. Understanding cost reconciliation helps to ensure transparency and efficiency in financial management, vital for any organization aiming for economic success. One of the most important steps in cost reconciliation is investigating discrepancies. Discrepancies are the differences or inconsistencies between the actual cost and the expected or budgeted cost of a project or process.

We are also excited about promising upside opportunities in Utah and California that should yield increasing benefits in 2025 and beyond,” said Fernando Araujo, Berry’s Chief Executive Officer. We have provided forecasted Consolidated Revenue and Adjusted EBITDA guidance for the quarter ending December 31, 2024 and the full year 2024 and 2025, which reflects targets for Adjusted EBITDA and net debt. Our Earnings Call on November 7, 2024 may present additional guidance that includes Adjusted EBITDA. Consolidated Selling, General & Administrative (“SG&A”) expenses increased $25.2 million, or 6.4%, during the three months ended September 30, 2024 compared to the same period of 2023. The increase was driven primarily by higher non-cash trade expense related to the 2024 Summer Olympics and the 2024 iHeartRadio Music Festival and an increase in costs incurred in connection with executing on our cost savings initiatives. However, generally accepted accounting principles (GAAP) require double-entry bookkeeping—where a transaction is entered into the general ledger in two places.

We believe these measures are an important indicator of the Company’s ability to service its long-term debt obligations. Excluding the impact of political revenue, Revenue from the Multiplatform Group and Consolidated Revenue decreased by 2.9% and increased 2.0% for the three months ended September 30, 2024 compared to the three months ended September 30, 2023, respectively. Excluding cash flow statement operating financing investing activities the impact of political revenue, Revenue from Audio & Media Services increased by 13.7% for the three months ended September 30, 2024 compared to the three months ended September 30, 2023. See the end of this press release for a reconciliation of revenue, excluding political advertising revenue, to revenue. As of September 30, 2024, we had $431.8 million of cash on our balance sheet.

You can compare the actual expenses incurred for each cost component with the budgeted or estimated expenses that were planned before the project or process started. This will help you to see if there are any variances or deviations between the actual and budgeted costs, and to understand the reasons behind them. For example, you may find that the actual cost of materials was higher than the budgeted cost because of a change in the market price or a shortage of supply. Or you may find that the actual cost of labor was lower than the budgeted cost because of a higher productivity or a lower wage rate. The cost reconciliation technique is essential for ensuring the accuracy of a business’s financial records.

Investigating discrepancies and conducting root cause analysis can help improve the cost reconciliation process and ensure the accuracy and reliability of the cost data. By following these steps and using these tools and techniques, one can identify and eliminate the root causes of the discrepancies and prevent or minimize them in the future. This can lead to better decision making, higher quality, lower risk, and greater customer satisfaction. One of the most important steps in cost reconciliation is identifying discrepancies or variances between the actual and expected costs of a project or process. Discrepancies can arise due to many factors, such as errors in estimation, changes in scope, delays, quality issues, inflation, currency fluctuations, etc.