To most accurately reflect its earnings per share, we need to know how many shares there were during the entire period — not just at the end. To do this, we need to calculate a weighted average of the company’s outstanding shares over the time period. A company that announces a 2-1 stock split as of a certain date doubles its number of shares outstanding on that date. If that event occurs on, say, December 15th of the year, it can distort the company’s apparent number of shares outstanding for the year.

Weighted Average Share Calculation Example #1

This journey through the nuances of WASO not only clarifies its importance but also empowers investors and analysts to make informed decisions. Ask a question about your financial situation providing as much detail as possible. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Why You Can Trust Finance Strategists

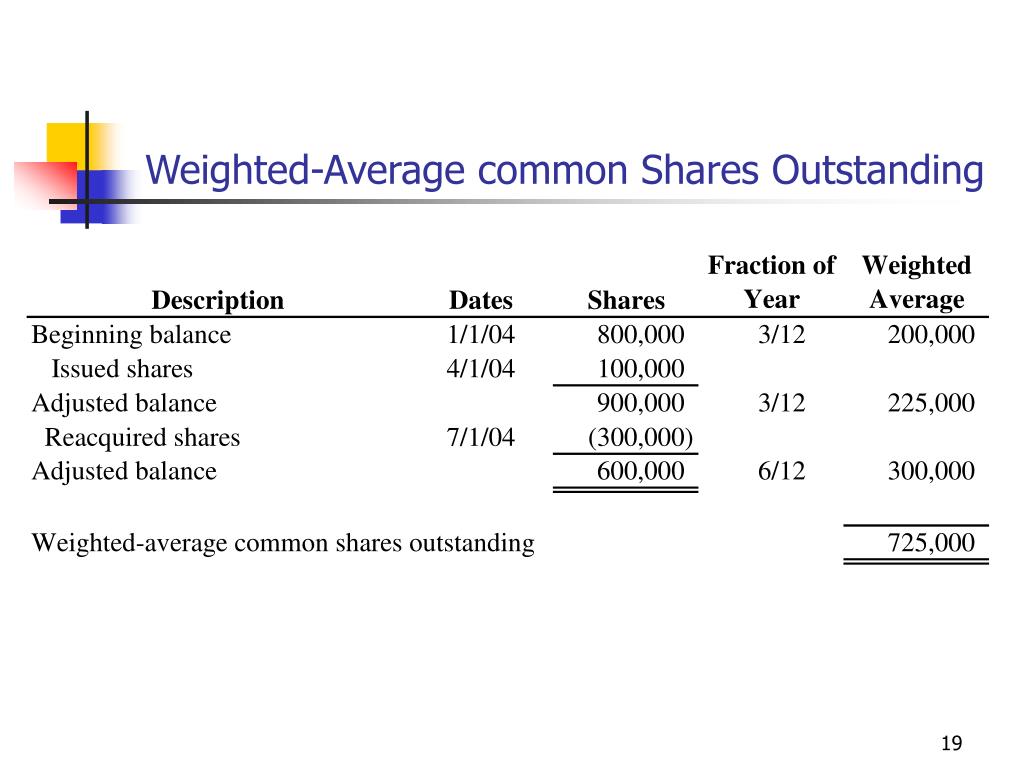

For example, if the denominator includes the whole of a group of new shares issued late in the year, it would not be consistent with the earnings derived from the resources available to the firm throughout the entire year. The below table shows the weighted averages shares outstanding calculation in a tabular format. Treasury stock consists of shares that the company has acquired in a buyback. These shares are held in the corporation’s “treasury” rather than in circulation and are therefore excluded from the number of outstanding shares.

Reverse Stock Split

- It is calculated by dividing the company’s earnings for a given period by the number of common shares outstanding.

- A company’s number of outstanding shares is not static and may fluctuate wildly over time.

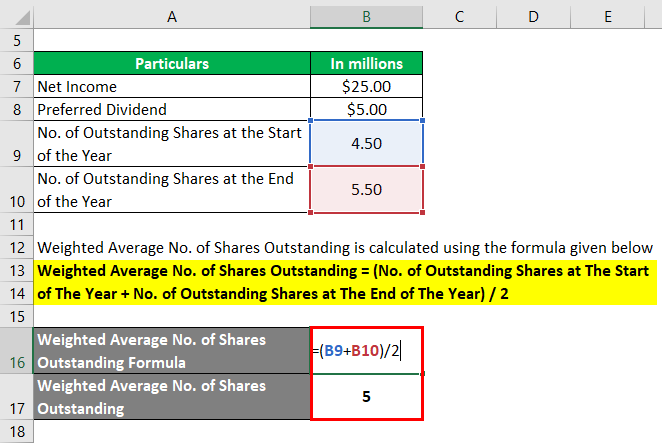

- The earnings per share calculation for the year would then be calculated as earnings divided by the weighted average number of shares ($200,000/150,000), which is equal to $1.33 per share.

- It can reverse-split its stock to keep its head above water, artificially increasing its share price.

For example, the opening figure of 500,000 remained unchanged for 3 months (i.e., 25% of the total time of the year) until the start of the second quarter, after which it changed. Notice that Alpha Inc. has ignored 25,000 shares issued on December 31 in above computation. The reason is that purchases journal format calculation and example these shares have been issued on the last day of the year and have not been outstanding during the year 2022. Changes occur due to stock issuance, buybacks, or corporate actions like splits. Each affects the share count differently but must be accurately reflected in financial analysis.

Group 2 consists of the 8,000 shares outstanding from 1 April to the end of the year and group 3 is the 12,000 shares outstanding from 1 April to 31 August. The weighting of each group by the fraction of the year it was outstanding is shown below. Below is the Weighted Average Shares calculation example when shares are issued and repurchased during the year.

Importance of a Weighted Average of Outstanding Shares

When a company issues a stock dividend or exercises a stock split, it needs to restate its outstanding shares of common stock before the date of stock dividend or split to compute its weighted average number of shares. It means that any additional shares issued as a result of stock dividend or split are assumed to be outstanding since the beginning of the year. Basic weighted average shares, on the other hand, represents the above-mentioned weighted average shares outstanding less the dilution of stock options for a specific period. Dilution occurs when a company issues additional shares that reduce an existing investor’s proportional ownership in the company. The weighted average shares outstanding, or the weighted average of outstanding shares, is a calculation that takes into consideration any changes in the number of outstanding shares over a specific reporting period. Investors, when investing for the long term, often compile a position in a stock over several years.

Along with individual shareholders, this includes restricted shares that are held by a company’s officers and institutional investors. The weighted average of shares outstanding is calculated based on the volumes of various share sales and purchases over a period of time. The weighted average calculation incorporates the beginning number of shares outstanding, plus additional shares that were sold or otherwise issued during the period, minus any shares that were bought back during the period. The weighted average number of shares is determined by taking the number of outstanding shares and multiplying it by the percentage of the reporting period for which that number applies for each period. In other words, the formula takes the number of shares outstanding during each month weighted by the number of months that those shares were outstanding.

These include a company’s market capitalization, such as market capitalization, earnings per share (EPS), and cash flow per share (CFPS). Weighted average shares outstanding is the number of company shares after incorporating changes in the shares during the year. E.g., buyback of shares, the new issue of shares, share dividend, stock split, conversion of warrants, etc. Thus, while calculating Earnings per Share, the Company needs to find the weighted average number of shares outstanding. It incorporates all such scenarios of changes in the weighted average number of shares to give fair Earnings per share value. Typically, a stock split occurs when a company is aiming to reduce the price of its shares.

Outstanding shares can also be used to calculate some key financial metrics, including a company’s market cap and its earnings per share. They are separate from treasury shares, which are held by the company itself. Weighted average outstanding shares are an important factor during the calculation of earnings per share for the Company.